Relief Grants

Relief grants are intended to support business operators who have suffered losses as a result of the pandemic. The Act on Relief Grants applies thereto. Their object is to ensure that operators can maintain necessary minimum operations while the effects of the pandemic persist, maintain business relations and ensure readiness when the pandemic subsides.

Those individuals and legal entities engaged in business or independent activity before 1 October 2020 and that have suffered not less than a 60 percent drop in income attributable to the worldwide coronavirus pandemic have a right to receive a relief grant from the Treasury, subject to certain conditions.

Institutions, regional co-operation agencies and companies that are majority owned by the state or local governments cannot apply for a relief grant.

The application deadline is 31 December 2021.

Basic prerequisites

1. The applicant must be unconditionally subject to taxation in this country

Being unconditionally subject to taxation means that the person or entity concerned must be subject to taxation on all income in this country, wherever it is earned. Further information on unconditional taxation can be found on the website of the Internal Revenue for individuals and legal entities.

This means that entities not subject to taxation, such as sports clubs, charities et al., are not entitled to a relief grant.

2. Businesses and independent activity

Only those engaged in business or who are independently employed can apply for a relief grant. This applies to the activity of an entity that pays wages according to withholding tax law and is registered on a wage payer registry as well as on the VAT registry, as applicable. In exceptional cases, account may be taken of operating results according to 2020 tax returns. Further information on the wage payer registry and the VAT registry may be accessed on the website of the Internal Revenue.

Further conditions for a relief grant

A business that fulfils all of the following conditions has a right to a relief grant from the Treasury pursuant to an application therefor.

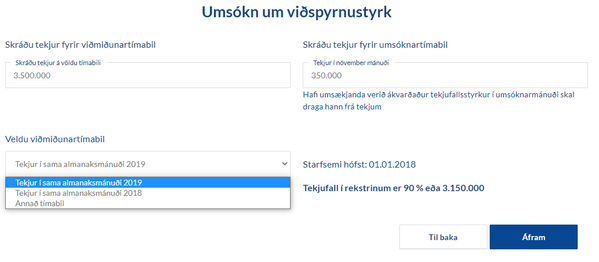

60% of the revenue loss attributable to the coronavirus pandemic

The income of the business in the calendar month to which the application relates must have been at least 60% lower than the average in the same month in 2019, and the drop must be attributable to the worldwide coronavirus pandemic or to public measures to prevent its spread. In the event that the applicant began operations after the beginning of the same calendar month in 2019, account shall be taken of average income during an equal number of days that are in that calendar month to which the application relates from the time that operations began to the end of October 2020. Under special circumstances, another period may be used as reference if the operator can show that this gives a better picture of its revenue loss than the reference period pursuant to sub-paragraphs 1–2. In such cases, account shall be taken of income during the same calendar month in 2018.

If a revenue loss grant has been determined for the operator for the calendar month to which the application relates, such grant shall not be considered as income in that month in calculations of revenue loss.

If the applicant has been paid closure support, due to closure during the period to which the application applies, such payment shall be deducted from the relief grant.

If the applicant has received support for wage costs during a period of notice for the calendar month to which the application applies, such amount shall be deducted from operating expenditure in the calculation of a relief grant.

If the operator has received a grant from the Unemployment Insurance Fund according to the Regulation on the participation of job seekers who are insured within the unemployment insurance system in labour market measures and on the payment of grants from the Unemployment Insurance Fund, No. 918/2020, or according to the calendar month to which the application applies, the amount of this support shall be deducted from operating costs.

Received unemployment benefits for the month to which the application applies shall also be deducted from operating costs.

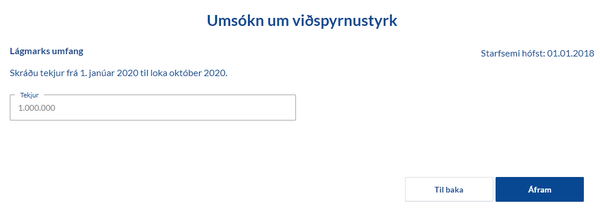

Minimum amount of income

The income of the applicant from 1 January 2020 to the end of October 2020 must have been a minimum of ISK 500 thousand. If the operation began after 1 January 2020, income shall be recalculated for the period that the applicant operated to the end of October 2020 to 305 days reference income.

Not in default on public dues and having filed all data

The operating entity must not be in default on public dues, taxes and tax fines beyond the last due date before the end of 2019. Default in this context covers dues and taxes that should have been paid in the year of 2019 and which remained outstanding at the end of the year even if a payment plan or agreement on payment was made after such time.

The operating entity must also have filed a tax return and other documentation and data at the appropriate time for the past three years, or since activity commenced, before an application for a relief grant is filed, as well as annual accounts, as applicable, along with information on the actual owners of the concern. Taxes and dues imposed may therefore not be based on estimates, including withholding tax and value added tax in 2020.

These prerequisites mean that the applicant must have filed all documents required by law for the past three years before the application date. This means, inter alia, that legal entities and individuals with operations must have filed a tax return in 2018, 2019 and 2020, unless operations have not lasted that long.

The applicant may remedy any deficiencies present by settling the default by year-end 2019 and/or submit documentation and then apply for a grant.

No bankruptcy or winding-up

An operating entity may not have been wound up or its estate been placed into bankruptcy.

Amount of relief grant

The amount of the relief grant shall be 90% of the operating costs of the applicant during the calendar month to which the application applies but never more, however, than the calculated revenue loss. Included in operating cost is the imputed withholding tax of the person or persons heading the operating activity.

Instead of including presumptive income for the application month as operating costs, the same amount as the applicant charged for presumptive income in that month in the tax returns for the 2019 operating year may be accounted as operating costs. If the operator has received unemployment benefits for the month to which the application applies, these are deducted from such calculated operating costs.

Maximum amount of relief grant

If the income shortfall is in the range of 60–80%, the maximum shall be ISK 400,000 for each full-time position per month, although never higher than ISK 2 million per month.

If the income shortfall is more than 80%, the maximum shall be ISK 500,000 for each full-time position per month, although never higher than ISK 2.5 million per month.

Closure support already received shall be deducted from the relief grant.

A relief grant shall be counted as taxable income of the operating entity.

Wage earner

A wage earner is a person who receives pay for a job performed at the responsibility of the wage payer, or a person who shall be subject to imputed withholding tax for work on his/her own operating activity or self-employment, including activity in partnership with someone else or under the auspices of a legal entity, such as, for example, a private limited company. The spouse of the person or child shall also be counted as wage earners in this context if they perform work for the operating activity.

Full-time positions

A full-time position is an employment proportion that is equivalent to the full-time work of a wage earner for one month. This means that a single wage earner can, at the most, be equivalent to one full-time position provided he works full-time for the operator for a whole month. Two wage earners working half-time for one month are equivalent to one full-time position. In the same manner, a wage earner working full-time for the operator for half a month is equivalent to a 50% position. A single wage earner cannot be regarded as more than one full-time position within the meaning of the law even if he works full-time as well as overtime for one month.

Full-time positions are not calculated for the work of contractors, as they are independent entities that, as appropriate, can themselves apply for a relief grant.

An operator who applied for partial unemployment benefits during the revenue loss period shall base the employment ratio of the wage earner in question on the employment ratio that the wage earner worked for him during the period. For example, if a wage earner that was previously in a full-time position reduced his employment percentage to 25% and accepted unemployment benefits for the remainder through the partial unemployment benefits scheme, the calculation of the employee's full-time position in the month in question is 25% in the calculation of the relief grant.

If the operator began operations after the beginning of the same month in 2019 as the application for a relief grant applies to, the number of full-time positions may be based on the average number of monthly full-time positions of the operator during the whole calendar months in 2019 when operating.

Operating costs

In determining a relief grant, account is taken of operating costs for each application month. A deviation is authorised regarding the imputed withholding tax as described above in the section “Amount of relief grant”.

The operating cost in this context is in accordance with the general definition of what belongs to costs as opposed to depreciation or the lowering of assets.

According to the Income Tax Act, the operating expenses are those expenses in the year that have resulted from the making of the income, establishing it and maintaining it. This includes premiums that employees pay to acquire pension rights in a pension fund that operates on the basis of the Act on Compulsory Insurance of Pension Rights and the Operations of Pension Funds, interest from debt, discounts, foreign exchange rate loss, write-down and depreciation of assets, as per further instructions in this Act, and amounts spent to establish and maintain a return from assets in the business.

Furthermore, the remuneration that a person is to allocate to him-/herself for any kind of work, occupation or services that are to be regarded as income in accordance with paragraph 2 of item 1 in section A of Article 7 is regarded as operating expenses. This applies irrespective of whether the remuneration has been paid. If the remuneration has been paid, the method of payment is also irrelevant, be it in cash, a transfer to a personal account, in kind or in benefits or through work exchange.

Further information on operation costs (expenses) of operating entities can be accessed on the Guidelines for the operating tax return on the website of the Internal Revenue (pp. 16–21).

Other issues

Related parties

The total amount of a relief grant to related parties can reach a maximum of ISK 120 million, including closure support, revenue loss grant and support according to the Travel Gift Act No. 54/2020.

Publication of information

The Internal Revenue shall publish public information on which legal entities have been accorded a relief grant. Information shall be published on all support recipients and amount of support equivalent to EUR 100 thousand or more.

Application

The application for a relief grant is electronic through the website skattur.is. If the applicant is a company (legal entity), the person holding the power of procuration shall register through his/her service access and thus enter the site of the company. A self-employed person enters the application through his/her own service access.

The application deadline is 30 June 2021.

The Internal Revenue shall process an application no later than two months after an adequate application has been received.

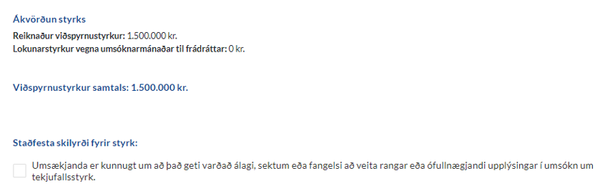

An operating entity shall confirm at the time of the application that it satisfies prerequisites for a relief grant, that the information underlying the determination of the amount, i.e. regarding operating costs, income and the number of wage earners, is correct and that it is aware that it may entail a surcharge, fine or imprisonment to provide wrongful or inadequate information.

Upon the processing of an application and the review of a decision on an application, the Internal Revenue can request that an operating entity substantiates with documentation its right to a relief grant.

The redetermination of a relief grant

It is being assumed that the Internal Revenue will redetermine a relief grant if it emerges that the operating entity had no right to the support or had the right to higher or lower support than it had been paid. The provisions of the Income Tax Act apply, as applicable, in this context, in addition to the provisions of the Relief Grant Act.

Excess payment

If it emerges that a party has received a relief grant in excess of what it had a right to, it shall refund the excess amount with interest from the date of payment. Late payment interest is applied to a claim for refund if not remitted within one month from the date of redetermination by the Internal Revenue.

Surcharge and penalties

If an operating entity has provided wrongful and inadequate information on operating expenses or if its provision of information has in other respects been so inadequate that it has affected the determination of a relief grant, the Internal Revenue shall apply a 50% surcharge on its claim for refund. The surcharge shall be cancelled if said party can substantiate that unforeseen circumstances had prevented it from providing rightful information or if it had provided a correction to the Internal Revenue.

If the Internal Revenue maintains that the behaviour of the operating entity could be subject to fines or imprisonment, it shall not be subjected to a surcharge, but the case shall be referred to the police.

Directions on application

To access an application form for revenue grants

Applications for a revenue grant must be delivered no later than 30 June 2021.

Application for a company

Application for a company

If an application is made for a company, the holder of the powers of procuration signs in to his own page, which shows what companies he is linked to. Once the button “Companies I am linked to” is selected, a list of such companies will appear. The holder of the powers of procuration is to select the company for which the application is to be made and thereby enters its service site. The homepage of the company will display an application box, although it is also possible to go through the communications tab.

(Possible to open and fill in application on the company's services site, but only the holder of powers of procuration has the authority to complete the application and send it for signing).

Applying as a self-employed person

Applying as a self-employed person

Self-employed persons enter to their own pages and select the application in the communications tab, in which case the same kind of box will appear. Application for relief grant

The application will only be available to those on the wage payer registry and who are domiciled in Iceland on the date of the application.

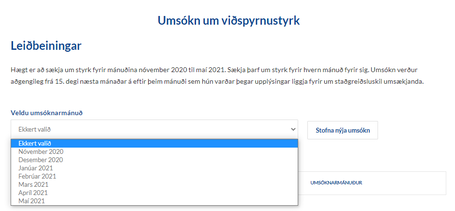

One application per calendar month

There is one application per calendar month from and including November 2020 to and including May 2021. You can only apply for one month at a time. Example: An operator applies for a relief grant for November 2020. He cannot apply for December 2020 or, as appropriate, other months during the period in question before he has digitally signed the earlier application.

Investigation into the fulfilment of requirements

On signing in, a check is made of whether the applicant fulfils certain basic conditions. If the conditions are not met, he will not be able to continue the application process. This applies e.g. if the applicant is in arrears with respect to public charges that had a final due date prior to the end of 2019, has not submitted tax returns or has not submitted periodic declaration reports on withholding taxes or VAT. Please note that such defaults may be paid, and data submitted, and the application site then re-entered and an application filed.

Conditions met

If the applicant is not stopped at the first check, the option of continuing with the application opens up. The next step reviews various conditions that must be fulfilled to be entitled to a relief grant, and the applicant must check the box at the bottom of the text to confirm that he does so. After that, the applicant can continue with the application.

Next is a page where the applicant will need to enter his e-mail and telephone number or that of a contact person. Next is a page to register the bank account number of the applicant. The entered information is shown and can be changed if necessary. A new account is registered by clicking on “”. When the relief grant is determined, it will be paid into this bank account.

State assistance

The next questions relate to state assistance. If the applicant has received closure support for periods after 17 September 2020, this is endorsed. The same applies to what the applicant may have been paid with travel gifts according to Act No. 54/2020 and loss of income grants according to the Act on Loss of Revenue Grants.

If the applicant has received other support that can be considered as state assistance, questions relating thereto must be answered by checking the “Yes” box. Entry fields will appear where the amounts are to be entered and the nature of the support specified.

Related parties

If the operator is connected to other companies, as owner, manager or has control thereof, according to the definition stated on the site, questions relating thereto must be answered by checking the “Yes” box. Entry fields will appear where the ID Nos. of the related companies are to be specified.

Loss of revenue

On the next page of the application, the loss of revenue will be calculated. Begin by stating revenue in the period between 1 January to the end of October 2020. This must be at least ISK 500,000 for the relief grant to be considered.

Next, fill in income in during the months to which the application applies and the reference period. As a rule, the reference period is the same calendar month in 2019 as the month applied for in 2020 or 2021. Example: An application for a relief grant is made for November 2020, and in such case, the general rule is that the reference period for the calculation of loss of revenue is November 2019.

If the applicant is of the opinion that another period gives a correct picture of the loss of revenue in his operation for special reasons, another reference period can be selected from the list. As a rule, 2018 is used for reference in such case. Applicants may expect to be asked why they are of the opinion that another period should be selected rather than that which the general rule provides for.

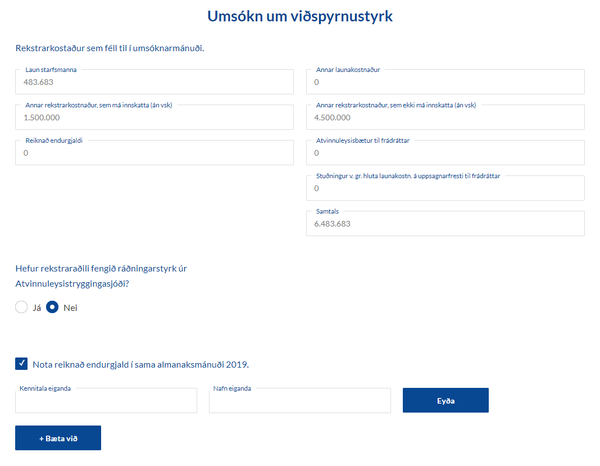

Operating costs

The applicant will have to provide information on the operating costs in the application month. April to October 2020. The wages of employees have been endorsed according to information from the RSK income tax records. For individuals, the presumptive income is also endorsed.

The applicant can choose to use the 2019 presumptive income, according to the 2020 tax return, instead of the presumptive income in the application month. If the legal entity selects this option, the owners that had presumptive income in 2019 are to be registered.

The amount of the loss of revenue grant is equivalent to 90% of the operating costs as specified in the applications, but never higher than the calculated revenue loss and the maximum specified in Article 5 of the Act, i.e. either ISK 400,000 or ISK 500,000 for each full-time position at the operator's in the month or the same month in 2019, taking account of loss of revenue, and can at most be ISK 2 million if the loss of revenue is 60–80% and ISK 2.5 million if the loss of revenue is more than 80%.

The applicant must state whether he has received an employment grant from the Unemployment Insurance Fund. If information about this is available, such information is endorsed and used for the reduction of the grant amount. The applicant shall correct the amount if it is incorrect.

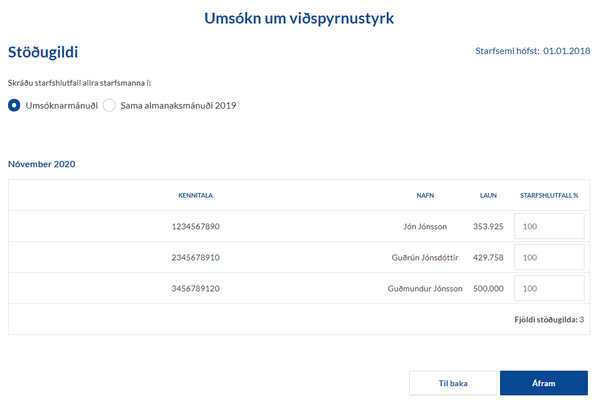

Full-time positions

The relief grant is calculated from, among other things, the number of full-time positions in the operation. The next page of the application shows a list of the wage payments of the applicant for the application month. The employment proportion of all employees in each month must be registered; 100 for a full-time position, 50 for 50% employment, etc. Positions as current during the same calendar month in 2019 may be used for reference, in which case such option is to be selected by checking the appropriate field.

If the operator began operations after the beginning of the same month in 2019 as the application for a relief grant applies to, the number of full-time positions may be based on the average number of monthly full-time positions of the operator during the whole calendar months in 2019 when operating.

Send application

Once all positions have been registered and the “Continue” button clicked, a page will appear where all the information is summarised: conditions, criteria and results. Relief grants are calculated based on the supplied information and the amount shown to the applicant.

The applicant must carefully review all the information and confirm that he understands that incorrect information may lead to the imposition of surcharges, fines or imprisonment. Once the information has been confirmed, it is possible to send the application for signing. In the case of legal entities, only the holders of the power of procuration may send an application.

Application finalisation

Next the applicant will receive a receipt stating that the application has been sent for signing with electronic ID. Signing is through the service site of the holder of the powers of procuration. The site will show that he has pending documents for signing. The notification is to be clicked and the signature appended.

Note should be made of the fact that an application is not considered delivered until after it has been electronically signed and will not be processed until after the signature has been attached.

Right of referral

The determination of the Internal Revenue regarding a relief grant may be appealed to the Internal Revenue Board. The period of referral and the handling thereof shall be in accordance with the provisions of the Internal Revenue Board Act.