Personal tax credit

General

Personal tax credit is a tax deductions people can use to lower the tax withdrawn from their salaries by their employer. People 16 years and older who are domiciled in Iceland are entitled to personal tax credit. Those turning 16 get full personal tax credit for the entire year, no matter when their birthday is within the year.

Personal tax credit 2024: 64,926 ISK

View personal tax credit amounts month by month

How do I use my personal tax credit?

Before wages are paid, the employer must be informed of the following about the personal tax credit and tax bracket:

Whether to use personal tax credit

As of which month

Cumulative personal tax credit information (if applicable)

Which tax bracket.

Information about your personal tax credit can be found on www.skattur.is, by logging on with your electronic ID og Skatturinn password.

See the video below for general information.

Video opens on youtube.com. English subtitles available.

Instructions on how to access information about your personal tax credit

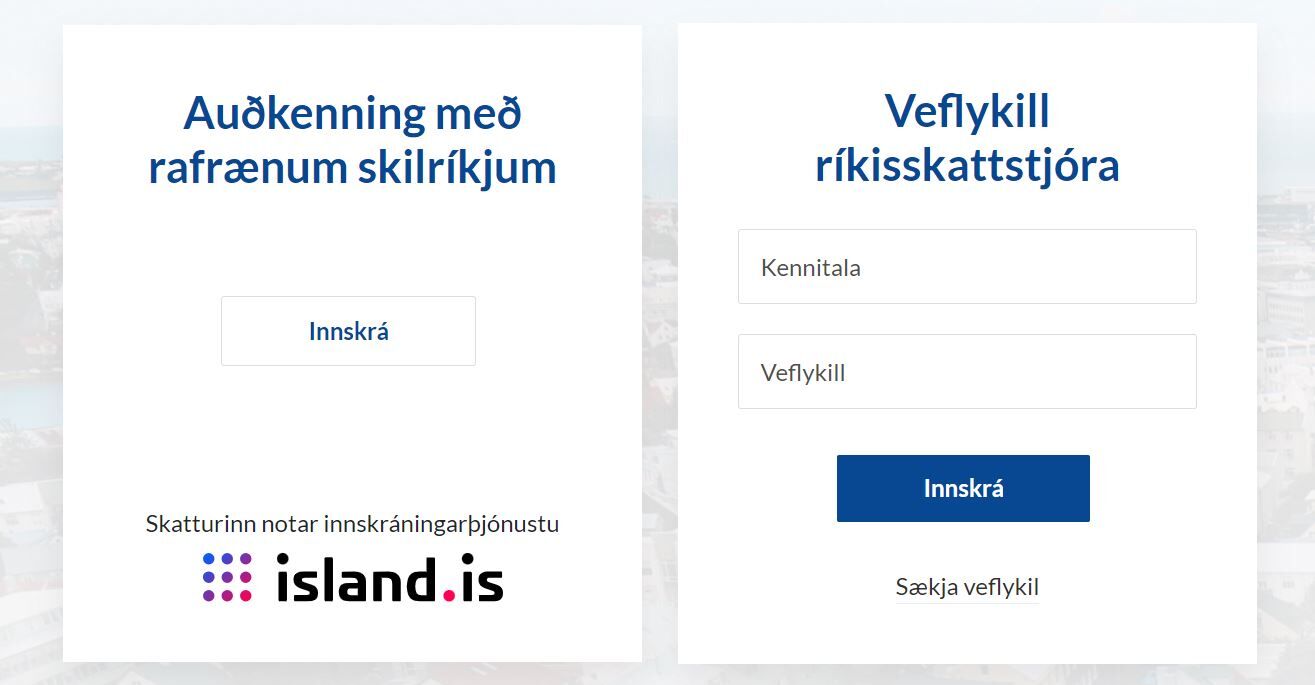

1. Individuals can access information on their own personal tax credit by logging in to www.skattur.is with their electronic ID or RSK password (veflykill).

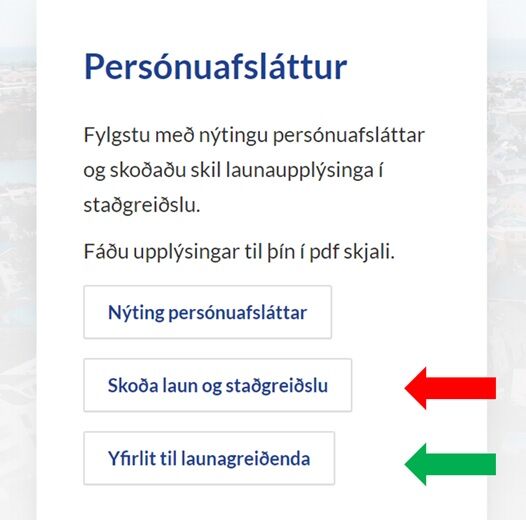

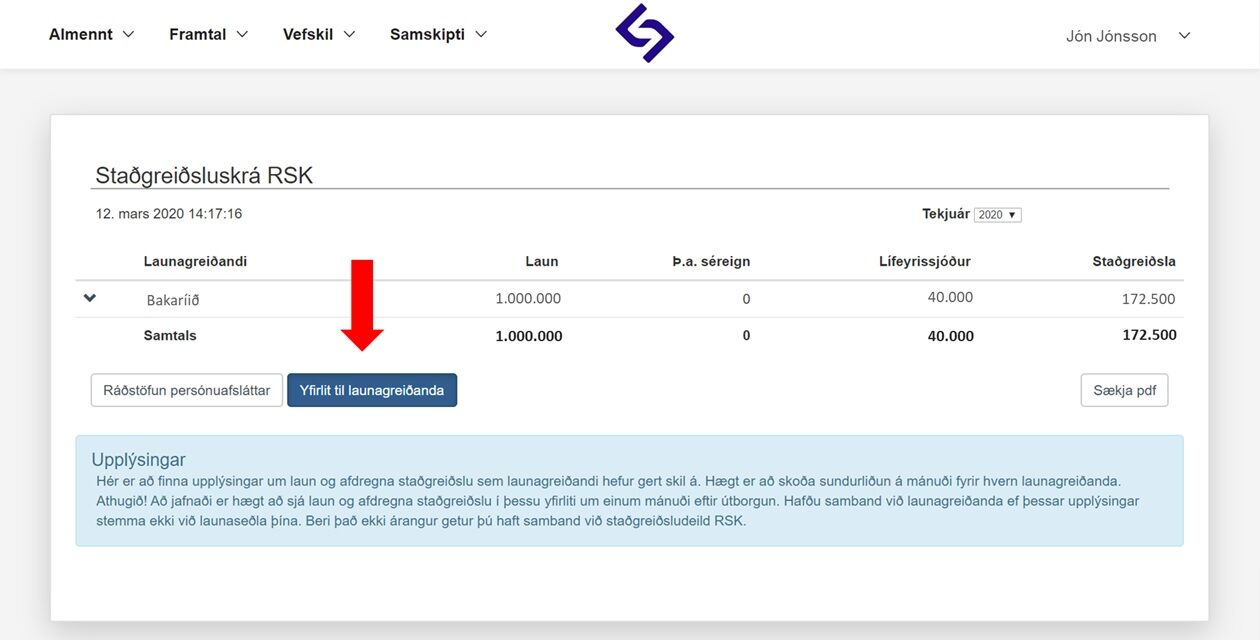

2. Once logged in press the button „skoða staðgreiðslu“ to view salary information employers have reported to the tax authorities within the year or go directly to the statement for your employer by pressing „yfirlit til launagreiðanda".

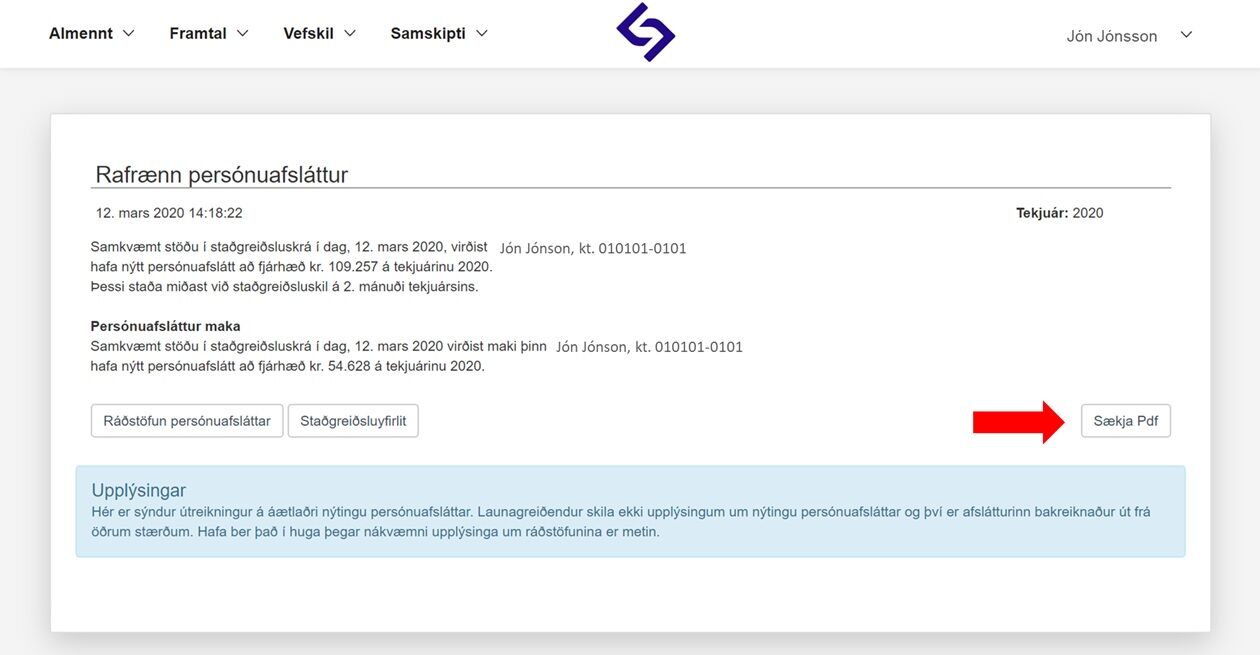

3. When switching employers, the new employer may require a confirmation of an employee's tax credit balance. The website offers a special statement for this purpose available to individuals by pressing the button „yfirlit launagreiðenda“.

4. This statement shows only information relevant to your new employer and can be printed out or extracted as a pdf document.

Payments from two or more employers

Persons receiving payments from more than one employer can divide the personal tax credit between the employers to enjoy their full deduction. If the salary from one employer is above a certain limit it is best to use all of the tax credit there instead of dividing it up. For further reference the salary tax calculator can be used.

Video opens on youtube.com. English subtitles available.

Responsibility for correct information

It is the responsibility of each individual to inform their employer of the correct tax bracket and how the personal tax credit is to be used so that the correct tax is deducted from wages at the time of payment.

Employers do not have access to information on the use of the personal tax credit of other employers.

In the event of over-utilization of a personal tax credit or payment at the wrong tax level, this can lead to too little tax being paid. This can cause the tax assessment at the end of the year to be negative. In the end, it is the individual who has to pay that debt.

Cumulative personal tax credit

Personal tax credits that are not used for one month accumulate and can be used later in the year. If the accumulated personal tax credit or the personal tax credit of a spouse is to be used, the employer must be informed of this.

A statement on personal tax credit usage can be found on www.skattur.is, by logging on with an electronic ID or Skatturinn password. This statement can be presented to an employer if needed.

Accumulated personal tax credit does not transfer from one year to another.

Special rules apply to the accumulation of a personal tax credit for non-residents.

Temporary stay or moving to or from Iceland

Those who move to or from Iceland during the income year or work temporarily in Iceland are only entitled to personal tax credit for the days they are domiciled in Iceland.

In these cases, the statement of used personal tax credit can give false hope of accumulated tax credit for the whole year and not just the limited stay in Iceland.

Tax credit amounts

The personal tax credit maximum limit is 64,926 kr. per month. The table below show the maximum limit as it accumulates month by month.

| Month | Personal tax credit 2024 | No. months | Max limit |

|---|---|---|---|

| Janúar | 64,926 kr. | x1 | 64,926 kr. |

| Febrúar | 64,926 kr. | x2 | 129,852 kr. |

| Mars | 64,926 kr. | x3 | 194,778 kr. |

| Apríl | 64,926 kr. | x4 | 259,704 kr. |

| Maí | 64,926 kr. | x5 | 324,630 kr. |

| Júní | 64,926 kr. | x6 | 389,556 kr. |

| Júlí | 64,926 kr. | x7 | 454,482 kr. |

| Ágúst | 64,926 kr. | x8 | 519,408 kr. |

| September | 64,926 kr. | x9 | 584,334 kr. |

| Október | 64,926 kr. | x10 | 649,260 kr. |

| Nóvember | 64,926 kr. | x11 | 714,186 kr. |

| Desember | 64,926 kr. | x12 | 779,112 kr. |

| Month | Personal tax credit 2023 | No. months | Max limit |

|---|---|---|---|

| January | 59,665 kr. | x1 | 59,665 kr. |

| February | 59,665 kr. | x2 | 119,330 kr. |

| March | 59,665 kr. | x3 | 178,995 kr. |

| April | 59,665 kr. | x4 | 238,660 kr. |

| May | 59,665 kr. | x5 | 298,325 kr. |

| June | 59,665 kr. | x6 | 357,990 kr. |

| July | 59,665 kr. | x7 | 417,655 kr. |

| August | 59,665 kr. | x8 | 477,320 kr. |

| September | 59,665 kr. | x9 | 536,985 kr. |

| October | 59,665 kr. | x10 | 596,650 kr. |

| November | 59,665 kr. | x11 | 656,315 kr. |

| December | 59,665 kr. | x12 | 715,981 kr. |

Tax credit in previous years

| Year | Personal tax credit per month |

|---|---|

| 2023 | 59,665 kr. |

| 2022 | 53,916 kr. |

| 2021 | 50,792 kr. |

| 2020 | 54,628 kr. |

| 2019 | 56,447 kr. |

| 2018 | 53,895 kr. |

| 2017 | 52,907 kr. |

| 2016 | 51,920 kr. |

| 2015 | 50,902 kr. |

| 2014 | 50,498 kr. |

| 2013 | 48,485 kr. |

| 2012 | 46,523 kr. |

| 2011 | 44,205 kr. |

| 2010 | 44,205 kr. |

| 2009 | 42,205 kr. |